Freedom Is Closer Than You Think – Here’s How I Built It Systematically

Imagine waking up knowing your money works for you, not the way around. I didn’t always have this. I once chased quick wins, fell into risky traps, and felt stuck. But everything changed when I shifted from random investing to a systematic approach. It wasn’t magic—just smart use of proven investment tools, disciplined habits, and clear goals. This is how I gained control, reduced stress, and moved steadily toward financial freedom. Let me walk you through what actually works.

The Myth of Fast Money and the Real Path to Financial Freedom

Many people dream of sudden wealth—a winning stock pick, a viral business idea, or an unexpected inheritance. These stories dominate headlines and social media, feeding the belief that financial freedom comes from luck or extraordinary risk. But for most individuals, especially those in their 30s to 50s managing households, careers, and long-term goals, this narrative is not only misleading—it’s dangerous. The reality is that lasting financial independence rarely results from a single event. Instead, it emerges from consistent, repeatable actions taken over years. The real path isn’t about getting rich quickly; it’s about building wealth slowly, deliberately, and with purpose.

When emotions drive financial decisions—fear during market downturns or greed during rallies—outcomes often suffer. Investors who panic-sell during a correction lock in losses, while those who chase hot trends frequently buy high and sell low. A systematic approach removes these impulses by replacing them with structure. It shifts the focus from unpredictable returns to reliable processes: regular contributions, diversified portfolios, and long-term compounding. This mindset doesn’t promise overnight success, but it does offer something more valuable: control, predictability, and peace of mind.

Consider two investors. One invests $500 a month into a low-cost index fund starting at age 35, earning an average annual return of 7%. By age 65, they’ve contributed $180,000 and accumulated over $550,000 due to compound growth. The other waits until 45 to start, investing the same amount under the same conditions. By 65, they’ve contributed $120,000 but only grown it to about $230,000. The difference isn’t intelligence or access to better tools—it’s time and consistency. This example illustrates why the myth of fast money fails: true wealth is built through patience, not shortcuts.

Laying the Foundation: Goals, Risk Tolerance, and Time Horizon

Before choosing any investment, it’s essential to understand your personal financial landscape. This begins with defining clear, realistic goals. Are you saving for early retirement? Planning to pay off your mortgage? Building a source of passive income to support your lifestyle? Each objective requires a different strategy, timeline, and level of risk. Without clarity on these goals, even the best investment tools can be misused. A system only works when it’s aligned with what you’re trying to achieve.

Risk tolerance is another cornerstone of sound planning. Some people can watch their portfolio drop 20% in a market correction without flinching; others feel anxiety at a 5% decline. Neither reaction is right or wrong, but understanding your emotional threshold helps shape a portfolio you can stick with. Someone with low risk tolerance might prioritize stable assets like bonds or dividend-paying stocks, while a higher-risk investor may allocate more to growth-oriented equities. The key is honesty—knowing how you truly respond to volatility, not how you think you should.

Time horizon plays a critical role as well. A 30-year-old saving for retirement has decades ahead, allowing them to ride out market fluctuations and benefit from long-term growth. In contrast, someone nearing retirement must protect accumulated wealth, favoring capital preservation over aggressive gains. A parent saving for a child’s college education in 10 years falls somewhere in between, requiring a balanced mix of growth and stability. These differences underscore why one-size-fits-all advice fails. A systematic plan must reflect your unique combination of goals, risk comfort, and timeline.

One practical way to assess these factors is through a simple self-evaluation. Ask: What am I investing for? How soon will I need the money? How do I feel when markets go down? Answering these questions creates a foundation for decision-making that isn’t swayed by market noise or social pressure. It transforms investing from a reactive gamble into a proactive, personalized strategy.

Core Investment Tools That Power Systematic Growth

With a clear foundation in place, the next step is selecting the right tools. Not all investments are created equal, and some are far better suited to systematic wealth-building than others. The most effective ones share common traits: low costs, broad diversification, and ease of access. Among these, index funds and exchange-traded funds (ETFs) stand out as powerful vehicles for long-term growth.

An index fund is a type of mutual fund that tracks a market index, such as the S&P 500. Instead of trying to beat the market by picking individual stocks, it aims to match its performance. Because it’s passively managed, it has much lower fees than actively managed funds. Over time, these savings compound, significantly boosting net returns. Historical data shows that most actively managed funds fail to outperform their benchmarks after fees, making index funds a smarter default choice for many investors.

ETFs operate similarly but trade like stocks on an exchange, offering flexibility and liquidity. They can track everything from broad markets to specific sectors or asset classes. For someone building a diversified portfolio, ETFs provide an efficient way to gain exposure to international markets, real estate, or bonds without needing large amounts of capital. Their low expense ratios and tax efficiency make them ideal for long-term investors focused on steady growth.

Dividend-paying stocks add another layer of value. These are shares in companies that regularly return profits to shareholders. Reinvesting dividends allows you to buy more shares over time, accelerating compounding. While individual stocks carry more risk, selecting established, financially healthy companies can provide both income and growth potential. When combined with index funds, they enhance portfolio resilience without requiring constant monitoring.

Bonds serve as a stabilizing force, especially as investors approach retirement. Government and high-quality corporate bonds offer predictable income and tend to hold value when stock markets decline. Including them in a portfolio reduces overall volatility, making downturns easier to endure. For midlife investors balancing growth and security, a strategic bond allocation can smooth the journey toward financial goals.

Finally, automated savings platforms—such as robo-advisors or employer-sponsored retirement plans—make it easier than ever to invest consistently. These tools handle everything from portfolio construction to rebalancing, often with minimal fees. By integrating them into a systematic plan, investors gain access to professional-grade strategies without needing advanced knowledge or constant oversight.

Automating Wealth: The Silent Engine Behind Consistent Results

If there’s one strategy that transforms average investors into successful ones, it’s automation. The act of setting up recurring contributions—whether $100 a month or $1,000—removes the need for constant decision-making. It ensures that investing happens regardless of market conditions, emotional state, or daily distractions. This consistency is what drives long-term results, not timing or market predictions.

One of the biggest obstacles to investing is hesitation. People often wait for the “right” moment to start, fearing they’ll buy at a peak. But markets are inherently unpredictable, and waiting for perfection usually means missing opportunities. Dollar-cost averaging—investing a fixed amount at regular intervals—solves this problem. When prices are high, you buy fewer shares; when prices drop, your money buys more. Over time, this smooths out purchase costs and reduces the risk of making a single bad decision.

Automation also combats procrastination, a common barrier for busy adults. Between managing households, careers, and family responsibilities, financial tasks often fall to the bottom of the priority list. By setting up automatic transfers from checking to investment accounts, you ensure progress happens even when life gets busy. Many employer-sponsored plans, like 401(k)s, already use this model—deducting contributions before you even see the money. Expanding this principle to personal accounts creates a seamless, disciplined approach.

Auto-rebalancing is another powerful feature offered by many digital platforms. As market movements shift your asset allocation—say, stocks grow faster than bonds—your portfolio can drift from its original risk profile. Rebalancing brings it back in line, selling high-performing assets and buying underrepresented ones. Doing this manually requires vigilance and emotional discipline; automation handles it quietly and objectively. This ensures your portfolio stays aligned with your goals without requiring constant attention.

The psychological benefit of automation cannot be overstated. Knowing that your investments are growing steadily, even during uncertain times, reduces stress and builds confidence. It turns investing from a source of anxiety into a background habit—like brushing your teeth or paying bills. Over decades, this quiet consistency becomes the foundation of financial freedom.

Risk Control: Protecting Your Progress Without Paralysis

Growth is meaningless without protection. Even the most well-designed plan can unravel if it lacks safeguards against unexpected events. Risk control isn’t about avoiding all danger—it’s about managing it intelligently. The goal isn’t to eliminate risk but to ensure it’s proportional to your goals, timeline, and emotional capacity.

Diversification is the first line of defense. Putting all your money into a single stock, sector, or asset class exposes you to unnecessary volatility. A diversified portfolio spreads investments across different areas—domestic and international stocks, bonds, real estate, and other assets—reducing the impact of any one failure. When one part of the market struggles, others may hold steady or even rise, balancing overall performance.

Asset allocation—the percentage of your portfolio dedicated to each asset class—is equally important. A young investor might allocate 80% to stocks and 20% to bonds, prioritizing growth. Someone nearing retirement might reverse that ratio to protect savings. These decisions should be based on your time horizon and risk tolerance, not market trends or media hype. Sticking to a predetermined allocation prevents emotional overreactions during market swings.

Emergency funds play a crucial supporting role. Life is unpredictable—job loss, medical expenses, or home repairs can arise without warning. Without cash reserves, you may be forced to sell investments at a loss to cover expenses. A well-funded emergency account—typically three to six months of living expenses in a liquid, accessible account—acts as a financial shock absorber. It allows you to weather crises without derailing long-term goals.

Regular reviews are also essential. Life changes—marriage, children, career shifts, or health issues—can affect your financial priorities. An annual check-in helps ensure your investment strategy remains aligned with your current reality. This isn’t about constant tinkering; it’s about intentional adjustments when needed. A systematic approach includes these reviews as part of the process, ensuring resilience over time.

Learning from Mistakes: What Setbacks Taught Me About Systems

No one builds a perfect financial system overnight. I’ve made my share of mistakes—trying to time the market, holding onto losing investments too long, and underestimating the impact of fees. Each misstep cost me time and money, but they also provided valuable lessons. The difference between failure and progress isn’t avoiding errors; it’s learning from them and improving the system.

One of my earliest mistakes was chasing performance. I saw a tech stock soaring and bought in, hoping to ride the wave. Within months, it crashed. I sold at a loss, feeling discouraged. What I didn’t realize then was that timing the market is nearly impossible, even for professionals. Studies show that missing just a few of the best performing days can drastically reduce long-term returns. A systematic approach avoids this trap by staying invested through ups and downs, focusing on time in the market rather than timing the market.

Another costly error was overtrading. I believed that frequent buying and selling would lead to better results. But each transaction came with fees and tax implications, eroding my gains. More importantly, constant activity introduced emotional decision-making. A disciplined system, by contrast, minimizes trading, relies on long-term trends, and reduces unnecessary costs. Simplifying my strategy not only saved money but also reduced stress.

I also overlooked the impact of fees for too long. High-expense-ratio funds and hidden account charges silently ate into my returns. Once I switched to low-cost index funds and transparent platforms, my net gains improved significantly. This taught me that small differences in cost can have massive long-term effects. A systematic plan includes regular fee audits, ensuring that every dollar works as hard as possible.

These experiences reinforced a key truth: resilience comes from structure, not perfection. A good system anticipates setbacks, includes feedback loops, and allows for course correction. It turns mistakes into data points, not disasters. For anyone building financial stability, this mindset shift—from fearing failure to expecting and learning from it—is transformative.

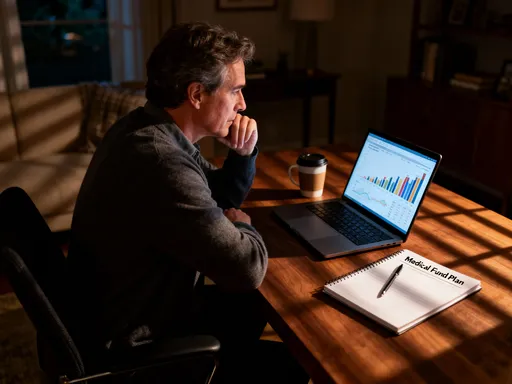

Building Your Own System: From Plan to Lifelong Practice

Creating a personal financial system isn’t about copying someone else’s strategy—it’s about designing one that fits your life. Start by evaluating your current habits. Are you saving regularly? Do you have a clear sense of your goals? Is your portfolio aligned with your risk tolerance? Honest answers reveal where to begin. The next step is choosing the right tools: low-cost index funds, ETFs, dividend stocks, and automated platforms that support consistency.

Set up automatic contributions to investment accounts, just as you would for bills or savings. Decide on an asset allocation that reflects your timeline and comfort with risk, then diversify across multiple asset classes. Open a dedicated emergency fund in a high-yield savings account. Schedule an annual review to assess progress, adjust for life changes, and rebalance if needed. These steps form the core of a sustainable, repeatable system.

The final piece is mindset. Financial freedom isn’t a single destination; it’s the result of daily choices compounded over time. It’s not about earning more or taking bigger risks—it’s about consistency, discipline, and clarity. Every contribution, no matter how small, moves you forward. Every review strengthens your foundation. Every year of compounding brings you closer to a future where money supports your life, rather than controls it.

You don’t need a financial crisis to start. You don’t need perfect knowledge or a huge income. What you need is a plan, the tools to execute it, and the commitment to stay the course. Freedom isn’t a distant dream reserved for the lucky or the wealthy. It’s closer than you think—built one deliberate, systematic step at a time.