Why Planning for Kindergarten Costs Starts with Smarter Asset Allocation

You’re not behind—just underinformed. When my child was two, I realized kindergarten wasn’t just around the corner; it was knocking. Tuition, supplies, activities—suddenly, expenses added up fast. I dove into asset allocation, not as a Wall Street pro, but as a parent who wanted control. What I learned? It’s not about how much you save, but where you place it. Let me walk you through what actually works. This isn’t about getting rich. It’s about being ready—without stress, without debt, and without last-minute panic. For families juggling daily budgets and long-term dreams, planning for early education can feel like trying to hit a moving target. But with the right strategy, it becomes not only manageable but empowering.

The Hidden Cost of Early Education

Many parents assume that because public kindergarten is tuition-free, it comes at no cost. While it’s true that core instruction in most public schools does not require payment, a growing number of associated expenses quietly accumulate throughout the year. These include classroom supplies, specialized learning kits, art materials, transportation for field trips, school spirit events, technology fees, and extracurricular enrichment programs. What begins as a $20 supply list can grow into hundreds of dollars when combined with seasonal events, fundraising expectations, and activity-based learning modules that are increasingly common in modern curricula.

Consider a typical scenario: a family with a four-year-old preparing to enter public kindergarten. At the start of the school year, they receive a list of required supplies—crayons, glue, scissors, notebooks, backpacks, and more. That initial outlay might total $75 to $150. Then come field trips—perhaps one per quarter. Even if each trip costs only $25, that’s another $100 annually. Add in class parties, holiday gifts for teachers, digital learning subscriptions, and unexpected requests for materials due to project-based learning, and the total easily exceeds $500 per year. In some districts, even basic items like tissues or hand sanitizer are requested monthly, placing ongoing pressure on household budgets.

These expenses may seem minor in isolation, but their cumulative impact is significant, especially for families already managing mortgage payments, childcare for younger siblings, or healthcare costs. The real danger lies in treating these costs as incidental rather than predictable. When parents fail to plan, they often dip into emergency funds or rely on credit cards to cover sudden charges. This reactive approach can lead to interest-bearing debt, disrupt other financial goals, and create stress during what should be an exciting milestone. Recognizing that kindergarten has financial dimensions beyond tuition is the first step toward responsible planning. Proactive budgeting transforms these hidden costs from surprises into line items—predictable, manageable, and integrated into a family’s broader financial picture.

Why Asset Allocation Beats Simple Savings

It’s natural to think of a savings account as the safest place for money set aside for a child’s education. After all, the funds are accessible, FDIC-insured, and free from market risk. However, relying solely on traditional savings accounts can be a slow path to falling behind. The average annual interest rate on standard savings accounts in recent years has hovered between 0.01% and 0.50%, while inflation has consistently averaged around 2% to 3%—and sometimes higher. This means that money sitting in a low-yield account is technically losing purchasing power over time, even if the balance appears stable.

For a goal like kindergarten funding, which typically falls within a five- to seven-year window, this erosion matters. Imagine setting aside $3,000 today to cover future expenses. If inflation averages 2.5% annually, that same amount will only have the buying power of roughly $2,650 in real terms by year five. To maintain value, the fund must earn returns that at least match inflation. This is where asset allocation becomes essential. Unlike simple saving, which keeps money static, asset allocation involves strategically distributing funds across different types of investment vehicles based on risk tolerance, time horizon, and financial objectives.

Asset allocation allows families to balance safety with growth. For example, a portion of the fund might go into short-term bonds or certificate of deposit (CD) ladders, which offer modest but predictable returns with minimal volatility. Another segment could be placed in broad-market index funds, which historically have returned around 7% annually over the long term, though with some year-to-year fluctuation. By combining these instruments, parents can aim for a net return that outpaces inflation while avoiding the high-risk bets associated with individual stocks or speculative assets.

The key insight is that risk is not just about market loss—it’s also about failing to meet your goal. Keeping all funds in cash carries the hidden risk of underperformance. Asset allocation mitigates this by introducing controlled growth potential. For parents, this doesn’t mean becoming investors overnight. It means making informed choices about where to park money so it works harder without exposing the family to unnecessary danger. The goal isn’t to maximize returns at all costs, but to optimize them within a safe, structured framework tailored to the timeline of early education expenses.

Mapping Your Timeline: From Diapers to Drop-Off

Time is one of the most powerful tools in financial planning, especially when preparing for predictable milestones like kindergarten enrollment. The earlier parents begin organizing their approach, the more flexibility and compound growth they can harness—even within a relatively short timeframe. A child’s journey from infancy to school readiness spans several years, each presenting unique opportunities to build, adjust, and refine a financial strategy. Viewing this period as a phased roadmap helps transform an overwhelming future expense into a series of manageable actions.

At age two, many families are still focused on day-to-day childcare needs, but this is actually the ideal time to enter the strategy phase. During this stage, the priority is awareness and assessment. Parents should begin tracking current spending patterns, estimating future education costs based on local school requirements, and evaluating how much they can realistically contribute each month. This isn’t about making large deposits yet—it’s about setting intentions, gathering information, and identifying potential funding sources. Some may choose to redirect a portion of baby-related savings (such as unused childcare subsidies or gifted items) toward education planning. Others may start small automatic transfers to a dedicated account, even if only $25 per month.

By age three, the focus shifts to fund structuring. This is when asset allocation decisions take shape. Families should open a designated account—such as a custodial brokerage or a high-yield savings vehicle—and begin implementing a balanced investment mix based on their risk comfort and timeline. Contributions become more consistent, and the portfolio is designed with both liquidity and growth in mind. For instance, a portion might be placed in Treasury Inflation-Protected Securities (TIPS), which adjust with inflation and help preserve value. Another segment could go into dividend-paying blue-chip stocks or low-cost ETFs that track the S&P 500. The goal is not aggressive speculation, but steady, diversified growth that aligns with the approaching deadline.

At age four, the rebalancing phase begins. As the child nears school entry, the portfolio should gradually shift toward more conservative holdings to protect accumulated gains. This means reducing exposure to volatile assets and increasing allocations to fixed-income instruments like municipal bonds or short-term CDs. Regular check-ins—quarterly or semi-annually—allow parents to assess performance, adjust contributions if income changes, and ensure the fund remains on track. This phased approach turns abstract worry into concrete progress, leveraging time as a strategic advantage rather than a source of pressure.

Building a Balanced Portfolio for Education Goals

Constructing a portfolio for kindergarten funding requires a careful balance between growth and preservation. Unlike retirement investing, which often spans decades and can withstand market downturns, education-related goals operate on a compressed timeline. This means the investment strategy must prioritize capital protection while still allowing for modest appreciation. The solution lies in a tiered allocation model that segments funds according to risk level, liquidity needs, and time sensitivity.

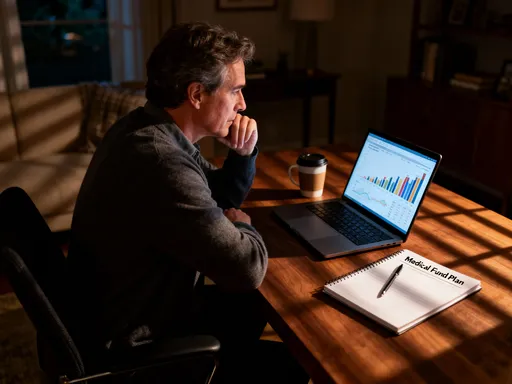

A practical starting point is the 50-30-20 framework, adapted for short-term goals. Fifty percent of the fund could be allocated to secure, low-volatility instruments such as Series I Savings Bonds, high-quality corporate bonds, or FDIC-insured money market accounts. These vehicles offer stability and predictable returns, making them ideal for safeguarding principal as the enrollment date approaches. Another 30% might go into moderate-growth options like index funds that track broad market performance—such as the total U.S. stock market or large-cap equities. These have historically delivered stronger returns over five-year periods than cash alone, though they come with some fluctuation. The final 20% can be used for limited exposure to higher-growth assets, such as sector-specific ETFs or international funds, but only if the family has a slightly longer horizon or higher risk tolerance.

Each component serves a distinct purpose. The secure tier ensures that a substantial portion of the fund remains untouched by market swings, providing a foundation of reliability. The moderate tier introduces upward momentum, helping the portfolio outpace inflation and grow incrementally. The growth tier offers optional upside, acting as a hedge against rising education costs without jeopardizing the core balance. Importantly, this model is not rigid—it should be adjusted based on individual circumstances, including income stability, existing savings, and local cost of living.

Liquidity is another critical consideration. Unlike long-term retirement accounts, education funds need to be accessible when bills arrive. Therefore, asset choices should favor instruments that can be converted to cash quickly and without penalty. For example, while a five-year CD might offer a good interest rate, it could impose early withdrawal fees that undermine flexibility. Instead, laddering shorter-term CDs (e.g., one-, two-, and three-year terms) allows families to access portions of their savings as needed while still earning competitive yields. Similarly, exchange-traded funds and mutual funds held in taxable accounts provide liquidity without lock-in periods, making them suitable for goal-based investing.

Risk Control: Protecting Your Education Fund

Even with a well-structured plan, no financial strategy is immune to disruption. Market volatility, unexpected job loss, medical emergencies, or sudden increases in living expenses can all threaten the integrity of an education fund. Rather than aiming for perfect safety—an unrealistic goal—the focus should be on intelligent risk management. This means anticipating potential setbacks and building safeguards that allow the plan to endure them without collapsing.

Diversification is the first line of defense. By spreading investments across asset classes, sectors, and maturities, families reduce their dependence on any single source of return. If one part of the portfolio underperforms—say, domestic equities dip during a correction—other components, such as bonds or international funds, may hold steady or even rise. This smoothing effect helps prevent emotional reactions, such as pulling out of the market at a low point, which can lock in losses. Diversification also extends beyond investments to income sources; dual-earner households or those with side income streams are better positioned to maintain contributions during economic shifts.

Periodic rebalancing is equally important. Over time, some assets grow faster than others, altering the original allocation. For example, if stock-based funds outperform bonds, the portfolio might shift from a 50-30-20 split to 40-40-20—increasing exposure to risk unintentionally. Rebalancing once or twice a year brings the mix back in line with the target, ensuring the strategy stays aligned with the goal. This discipline reinforces long-term thinking and prevents complacency.

Another key safeguard is the emergency buffer. Financial advisors often recommend maintaining three to six months of living expenses in a readily accessible account. For families saving for kindergarten, this cushion prevents the need to raid the education fund when unexpected costs arise. Without it, a car repair or medical bill could force premature withdrawals, derailing progress and potentially triggering tax consequences or penalties. The emergency fund and the education fund should be kept separate, each serving its own role in household stability.

Finally, insurance plays an indirect but vital role. Health, disability, and life insurance protect income streams that support ongoing contributions. If a primary earner becomes unable to work, these policies help maintain financial continuity. While not a direct investment tool, insurance is a foundational element of risk control—one that preserves the ability to save over time.

Practical Moves: Setting Up and Staying on Track

Knowledge is valuable, but execution is what delivers results. Many families understand the importance of saving for kindergarten but struggle with implementation. The gap between intention and action often stems from uncertainty about where to begin, how much to contribute, or how to monitor progress without becoming overwhelmed. A clear, step-by-step approach can bridge that gap and turn abstract planning into daily habits.

The first step is opening a dedicated account. This could be a custodial brokerage account (UTMA/UGMA), a high-yield savings account, or even a 529 plan if the family anticipates using the funds for broader educational purposes later. The key is separation—keeping education money distinct from general household funds reduces the temptation to divert it for other uses. Once the account is established, setting up automatic transfers ensures consistency. Even modest amounts—$50 or $100 per month—add up significantly over five years, especially when invested wisely. Automation removes the burden of remembering to save and makes the process nearly effortless.

Next comes contribution tracking. Families should review their progress at least quarterly, assessing whether they are on pace to meet their target. This doesn’t require daily monitoring or market obsession. A simple spreadsheet or personal finance app can track balances, investment performance, and remaining gaps. If life changes—such as a job shift, relocation, or new child—adjustments can be made to contribution levels or allocation strategies without abandoning the plan altogether.

Behavioral discipline is just as important as technical setup. Markets will fluctuate, and there will be periods when the portfolio value dips. It’s natural to feel anxious during downturns, but reacting emotionally—by selling off investments at a loss—can do more harm than good. Instead, parents should remind themselves of the timeline and purpose: this is not speculative trading, but goal-based saving. Staying the course, especially during volatile periods, is often the best strategy. Tools like dollar-cost averaging—investing a fixed amount regularly regardless of market conditions—help reduce the impact of timing risks and promote long-term discipline.

Finally, involving the whole family can strengthen commitment. While young children won’t grasp complex finance, they can participate in symbolic ways—decorating a savings jar, celebrating milestone deposits, or learning simple lessons about saving. These small rituals build financial awareness early and reinforce the value of planning. For parents, seeing progress—no matter how incremental—fosters motivation and confidence.

Looking Ahead: From Kindergarten to Long-Term Financial Health

Successfully funding kindergarten is more than a financial victory—it’s a confidence builder. When parents see that they can anticipate, plan for, and meet a meaningful expense, they gain a sense of control that extends far beyond one school year. This experience lays the groundwork for tackling larger goals: elementary school supplies, music lessons, sports fees, summer camps, and eventually college. The systems developed for kindergarten—automated savings, asset allocation, regular reviews—become reusable frameworks that scale with evolving needs.

Moreover, the discipline of early financial planning fosters healthier money habits across the household. Budgeting for education encourages mindful spending, prioritization, and long-term thinking. It shifts the mindset from reactive to proactive, from scarcity to strategy. Over time, these behaviors compound just like investments, leading to greater resilience, reduced stress, and improved decision-making in all areas of life.

Ultimately, asset allocation is not a one-time fix or a complex trick reserved for the wealthy. It is a practical, accessible skill that empowers ordinary families to navigate predictable expenses with clarity and calm. By aligning money with purpose, parents do more than prepare for school—they prepare for peace of mind. They teach their children, by example, that planning is an act of care, that responsibility brings freedom, and that financial wisdom begins not with wealth, but with intention.