Why Family Trusts Are the Smartest Move for Legacy Wealth

What if you could protect your wealth, skip the legal mess, and keep your family financially secure—without losing control? I’ve seen families lose everything to avoidable pitfalls, simply because they waited too long or trusted the wrong setup. After years in estate planning, I realized family trusts aren’t just for the ultra-rich. They’re practical, powerful tools that, when used right, shield assets, reduce stress, and ensure your legacy lasts. Let me show you how.

The Hidden Problem with Traditional Inheritance

For decades, writing a will has been the default method for passing down wealth. It feels like checking a box—something done out of duty, often with the help of a general attorney or an online template. But while a will can express final wishes, it offers little protection during the actual transfer of assets. When someone dies with only a will, their estate typically enters probate—a court-supervised process that validates the will, pays debts, and distributes property. This process may sound orderly, but in reality, it can be slow, costly, and emotionally draining for surviving family members.

Probate can take anywhere from several months to multiple years, depending on the state and complexity of the estate. During this time, assets like homes, bank accounts, and investment portfolios are often frozen. Families may struggle to cover daily expenses or make urgent decisions, especially if the deceased was a primary income earner. Legal fees and court costs can consume 3% to 7% of the estate’s total value—money that could have gone directly to loved ones. In some cases, disputes among heirs escalate into full-blown litigation, turning grief into conflict and draining even more resources.

Another overlooked issue is privacy. Probate records are public. Anyone can access details about the deceased’s assets, debts, and beneficiaries. This transparency can attract unwanted attention—from creditors to distant relatives—and even expose families to scams or predatory financial offers. For those who value discretion, this lack of confidentiality is a serious drawback. Moreover, a will does nothing to protect assets from creditors or divorce settlements once they’re transferred. A child who inherits a large sum could lose it all in a divorce or lawsuit, leaving future generations with nothing.

Perhaps most importantly, a will provides no ongoing management. Once assets are distributed, control ends. There’s no mechanism to ensure the money is used wisely or preserved over time. A young heir might receive a lump sum at age 18 or 21 and spend it quickly, undermining years of financial planning. These limitations reveal a fundamental truth: a will is a starting point, but it’s not a complete solution. For families seeking real protection, continuity, and control, a more sophisticated approach is needed—one that operates outside the court system and adapts to changing circumstances. That’s where the family trust comes in.

What a Family Trust Really Is (And What It’s Not)

A family trust is a legal arrangement in which one party, known as the grantor, transfers ownership of assets to a trustee, who manages them for the benefit of designated beneficiaries. Unlike a will, a trust can take effect while the grantor is still alive and continues to operate after their death. This continuity is one of its most powerful features. The trust itself is a separate legal entity, holding titles to property, investment accounts, and other valuable assets. It doesn’t replace a will entirely—most estate plans include a “pour-over will” to catch any assets accidentally left out—but it serves as the primary vehicle for wealth transfer.

There are three essential roles in any trust: the grantor (also called the settlor), the trustee, and the beneficiaries. The grantor creates the trust and decides how assets should be managed and distributed. The trustee, who can be an individual or a financial institution, has a fiduciary duty to act in the best interests of the beneficiaries. Beneficiaries are the people who receive benefits from the trust—typically spouses, children, or grandchildren. These roles can overlap; for example, the grantor can also serve as the initial trustee, maintaining control during their lifetime.

One of the most common misconceptions is that trusts are only for the wealthy. In reality, families with modest estates can benefit just as much. A home, retirement accounts, and life insurance policies can all be placed into a trust. Another myth is that setting up a trust means giving up control. This is true only for irrevocable trusts, which are designed for specific tax or asset protection purposes. Revocable living trusts, the most common type, allow the grantor to amend or dissolve the trust at any time. You can change beneficiaries, update distribution rules, or even reclaim assets if your circumstances change.

Trusts also don’t automatically eliminate taxes. While they can help reduce estate taxes in certain situations, they don’t provide a blanket exemption. Their real value lies in efficiency, privacy, and protection. A properly funded trust avoids probate entirely, allowing assets to be transferred quickly and privately. It also provides a clear framework for managing wealth if the grantor becomes incapacitated—something a will cannot do. By clarifying what a trust is and what it can realistically achieve, families can make informed decisions without being swayed by myths or fear-based marketing.

How Family Trusts Protect Wealth from Unseen Threats

One of the most compelling reasons to establish a family trust is protection. Wealth passed through a trust is insulated from many of the risks that can erode inheritance. Creditors, lawsuits, and divorce proceedings are among the most common threats. When assets are transferred directly to an heir, they become part of that person’s personal estate and are vulnerable to legal claims. A trust, however, can be structured to hold assets in a way that shields them from these external forces. For example, a discretionary trust gives the trustee the authority to decide when and how much to distribute, ensuring that funds are not seized in a lawsuit or divided in a divorce settlement.

Consider the case of a parent who leaves $500,000 to a child through a will. If that child is involved in a car accident and sued for damages, the inheritance could be used to satisfy the judgment. But if the same amount is held in a trust with proper provisions, it remains protected. The child can still receive income or support from the trust, but the principal is not directly owned by them. This distinction is crucial. It allows families to provide financial security without exposing assets to unnecessary risk. Similarly, in the event of a divorce, trust assets that are kept separate and managed independently are less likely to be considered marital property.

Another often-overlooked threat is financial immaturity. Many parents worry about leaving a large sum to a young adult who may not be ready to manage it responsibly. A trust can address this concern by setting conditions for distribution. For instance, a grantor might specify that a beneficiary receives one-third of the trust at age 30, another third at 35, and the remainder at 40. Alternatively, distributions can be tied to milestones like completing college, buying a home, or starting a business. These rules ensure that wealth is used constructively and preserved over time.

Market volatility is another factor. During economic downturns, heirs who inherit assets outright may be forced to sell investments at a loss to cover expenses. A trust, managed by a professional trustee or guided by clear instructions, can adopt a long-term strategy that rides out market cycles. It can also include provisions for emergency access, balancing protection with flexibility. By acting as a financial buffer, the trust helps maintain stability across generations, even in uncertain times. This level of safeguarding is simply not possible with a will alone.

Maximizing Control While Minimizing Taxes

Control is one of the most valued benefits of a family trust. Unlike probate, which places decision-making in the hands of the court, a trust allows the grantor to define exactly how and when assets are distributed. This control extends beyond death—it also covers situations of incapacity. If the grantor becomes unable to manage their affairs due to illness or injury, the successor trustee can step in seamlessly, avoiding the need for a court-appointed guardian. This continuity ensures that bills are paid, investments are monitored, and family needs are met without delay.

From a tax perspective, trusts offer strategic advantages, particularly for estates that exceed federal or state exemption limits. As of 2024, the federal estate tax exemption is approximately $13 million per individual, meaning most families won’t owe federal estate taxes. However, some states have lower thresholds and impose their own estate or inheritance taxes. A well-structured trust can help minimize these liabilities. For example, an AB trust—also known as a bypass trust—allows a married couple to fully utilize both of their exemptions, effectively doubling the amount that can pass tax-free to heirs.

Irrevocable life insurance trusts (ILITs) are another tool for tax efficiency. Life insurance proceeds are typically included in the taxable estate if the policy is owned by the deceased. By placing the policy in an ILIT, the death benefit is removed from the estate, reducing the overall tax burden. While irrevocable trusts require giving up control, the trade-off can be worthwhile for those with significant assets. Additionally, charitable remainder trusts allow donors to support causes they care about while receiving income during their lifetime and reducing taxable income.

It’s important to note that trusts do not eliminate income taxes. Earnings generated within a trust are still subject to taxation, and distributions to beneficiaries may be taxable as well. However, with proper planning, tax obligations can be managed effectively. The key is to align the trust structure with broader financial goals and consult with a qualified tax advisor. By combining control with tax-smart strategies, families can keep more of their wealth within the family and reduce the government’s share.

Choosing the Right Trust Structure for Your Goals

Not all trusts serve the same purpose. The right choice depends on individual circumstances, including net worth, family dynamics, and long-term objectives. The most common distinction is between revocable and irrevocable trusts. A revocable living trust offers flexibility—it can be modified or revoked at any time, making it ideal for those who want control during their lifetime. It avoids probate and provides for incapacity planning but does not protect assets from creditors or reduce estate taxes, as the assets are still considered part of the grantor’s estate.

In contrast, an irrevocable trust, once established, cannot be changed without the consent of the beneficiaries. This lack of flexibility is offset by significant benefits: assets are removed from the grantor’s estate, offering protection from creditors and potential tax advantages. Irrevocable trusts are often used for high-net-worth individuals seeking to preserve wealth and minimize estate taxes. However, they require careful planning, as transferring assets into the trust is a permanent decision.

Another distinction is between living trusts and testamentary trusts. A living trust takes effect immediately upon funding, while a testamentary trust is created through a will and only becomes active after death. The latter must go through probate, eliminating one of the main advantages of a trust. For this reason, living trusts are generally preferred for avoiding court involvement and ensuring smoother transitions.

Specialized trusts can address specific needs. A special needs trust, for example, allows families to provide for a disabled beneficiary without jeopardizing government benefits like Medicaid or Supplemental Security Income (SSI). A spendthrift trust restricts a beneficiary’s access to principal, protecting against poor financial decisions or exploitation. Selecting the right structure requires a clear understanding of goals and potential risks. There is no one-size-fits-all solution. A family with minor children may prioritize education funding and gradual distributions, while a blended family might focus on fairness and conflict prevention. Working with an experienced estate planning attorney ensures the trust is tailored to the family’s unique situation.

Common Mistakes People Make (And How to Avoid Them)

Even the most carefully designed trust can fail if basic steps are overlooked. One of the most frequent errors is failing to fund the trust. Creating the legal document is only the first step—assets must be formally transferred into the trust’s name. This includes updating titles on real estate, re-registering investment accounts, and changing beneficiary designations on life insurance and retirement plans. Without proper funding, the trust is essentially empty, and assets may still go through probate. This oversight is surprisingly common, even among those who believe they’ve completed their estate plan.

Another mistake is appointing the wrong trustee. Some people choose a family member out of loyalty, without considering their financial literacy or availability. Managing a trust requires attention to detail, record-keeping, and sometimes investment decisions. A well-meaning but unqualified trustee can make costly errors. Others name co-trustees without clarifying roles, leading to disagreements and delays. In some cases, it’s better to appoint a professional trustee or a corporate fiduciary, especially for complex estates or when family dynamics are strained.

Unclear instructions are another pitfall. Vague language like “distribute income as needed” gives the trustee little guidance and can lead to inconsistent decisions. It’s better to define specific criteria for distributions, such as education, healthcare, or housing. At the same time, too many restrictions can make the trust inflexible. Striking the right balance requires thoughtful drafting and periodic review.

Finally, many people set up a trust and never revisit it. Life changes—marriage, divorce, the birth of grandchildren, or shifts in financial status—can render an outdated trust ineffective or even harmful. Regular reviews, ideally every three to five years or after major life events, ensure the plan remains aligned with current goals. These mistakes are preventable with proper education and professional guidance. An experienced estate planning attorney can help avoid these pitfalls and ensure the trust functions as intended.

Building a Legacy That Lasts Beyond Money

Estate planning is often viewed as a financial exercise, but its deepest impact is emotional and relational. A family trust is not just a tool for asset protection—it’s a vehicle for传递 values, expectations, and care. Many families find that the process of creating a trust opens important conversations about money, responsibility, and legacy. Holding family meetings to discuss the purpose of the trust, the reasoning behind distribution rules, and the importance of financial literacy can strengthen bonds and reduce misunderstandings later on.

Some grantors choose to write a letter of intent to accompany the trust. This non-binding document explains their hopes for the family, shares personal memories, and offers guidance on how wealth should be used. It might encourage heirs to pursue education, support charitable causes, or start a business. Unlike the legal terms of the trust, this letter speaks from the heart, providing context and emotional clarity. It becomes a keepsake—a final message that endures long after the grantor is gone.

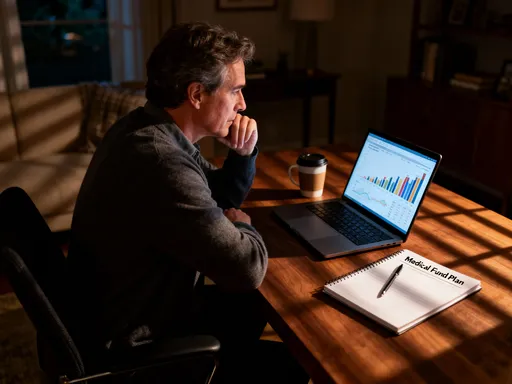

Financial education is another critical component. Trusts can include provisions for funding financial literacy programs for younger beneficiaries, ensuring they understand budgeting, investing, and responsible spending. Some families establish advisory boards or require periodic check-ins with a financial advisor. These practices foster accountability and help heirs develop the skills needed to manage wealth wisely.

In the end, a family trust is more than a legal document. It’s an act of foresight, love, and responsibility. It reflects a desire to protect, guide, and uplift future generations. When done thoughtfully, it transforms wealth from a number on a balance sheet into a lasting legacy of security, purpose, and connection. For families who want to leave more than just money, the trust is not just the smartest move—it’s the most meaningful one.