What I Learned Picking Products Before Our IPO

So you're thinking about going public? Yeah, me too—recently. And let me tell you, one of the quiet game-changers wasn’t just financial audits or legal paperwork. It was product selection. I didn’t realize how much our lineup would be dissected—by investors, analysts, even the media. We had to prove not just profit, but potential. This isn’t just about what sells; it’s about what scales, what tells a story, and what survives scrutiny. Here’s how we got it right—mostly the hard way.

The Hidden Pressure of IPO Readiness

Preparing for an initial public offering is often framed as a financial transformation, but the reality is far broader. While balance sheets, cash flow statements, and compliance frameworks are essential, the true test of a company’s readiness lies in its operational clarity—and that starts with the product portfolio. When our leadership team began the IPO journey, we assumed that strong revenue growth would be enough to capture investor confidence. What we didn’t anticipate was how deeply underwriters and institutional investors would scrutinize the composition of our offerings. Every product became a data point in a larger narrative about sustainability, scalability, and strategic focus.

Investors don’t just evaluate what a company is selling today; they assess whether the business can grow predictably over the next five to ten years. That means product lines are no longer judged in isolation—they’re weighed against long-term vision and market dynamics. Early in our preparation, our investment bankers raised concerns about three underperforming SKUs that collectively contributed less than 5% of total revenue. At first, we defended them as “stable niche products” with loyal customer bases. But the feedback was clear: these offerings diluted our story. They introduced complexity without meaningful upside and signaled a lack of discipline in portfolio management.

The turning point came during a due diligence meeting when an analyst asked, “If you had to cut one product tomorrow to sharpen your focus, which would it be—and why?” The question wasn’t about immediate cost savings; it was a test of strategic coherence. We realized that IPO readiness wasn’t just about cleaning up the books—it was about creating a business that looked intentional, focused, and built to scale. From that moment on, product selection shifted from a tactical marketing decision to a core element of financial positioning. We began viewing each SKU not just as a revenue generator but as a building block in a public narrative about who we were and where we were headed.

What Investors Actually Look For in Your Product Line

It's easy to assume that investors care only about top-line revenue or year-over-year growth. In reality, sophisticated institutional buyers dig much deeper. They analyze concentration risk, gross margins, customer lifetime value, and the scalability of unit economics. A company with five products each contributing 20% of sales might seem diversified, but if none have strong margins or clear growth paths, it raises red flags. Conversely, a business built around a single dominant product with high retention, strong margins, and expanding use cases can be far more attractive—even if it appears less diversified on the surface.

During our road to IPO, we conducted a comprehensive review of our entire product lineup using investor-grade metrics. We mapped each offering against four key dimensions: revenue contribution, profitability, customer dependency, and innovation trajectory. What emerged was a clear hierarchy. One flagship product accounted for 62% of revenue but generated nearly 78% of gross profit. It had a 91% annual retention rate and was increasingly being adopted by enterprise clients—a trend that signaled long-term expansion potential. Meanwhile, several smaller products showed modest sales but required disproportionate support, engineering time, and inventory management.

Armed with this data, we made the difficult choice to deprioritize the weaker performers. This wasn’t merely about improving financial ratios; it was about sending a message. Investors respond to focus. They want to see management teams making deliberate trade-offs rather than clinging to every revenue stream. By consolidating around our strongest offerings, we demonstrated confidence in our core value proposition. We could point to clear unit economics, predictable renewal cycles, and a scalable delivery model—all of which reduced perceived risk. The shift also allowed us to reallocate resources toward enhancing the leading product, further strengthening its market position and reinforcing the very attributes investors valued most.

Cutting the Noise: How We Streamlined Our Offerings

Letting go of products is never easy, especially when they’ve been part of the company’s identity for years. One of our oldest offerings, a specialized tool serving a narrow segment of our customer base, had been with us since the early days. It wasn’t a major revenue driver—only about 4% of total sales—but it had a loyal following and generated steady, low-effort cash flow. From an emotional standpoint, retiring it felt like abandoning part of our history. Operationally, however, it was a different story. The product required custom integrations, dedicated support staff, and ongoing maintenance that consumed engineering bandwidth better spent elsewhere.

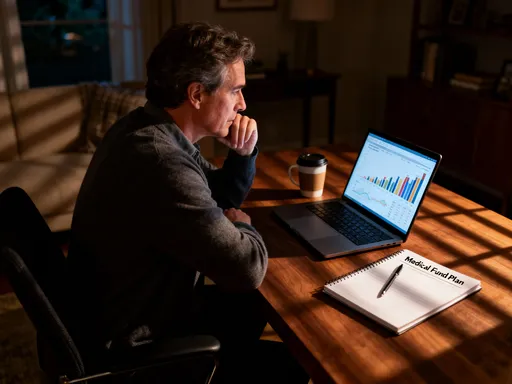

After months of internal debate, we decided to sunset the product. The decision followed a rigorous evaluation process that included customer impact analysis, cost-to-serve modeling, and scenario planning. We projected that discontinuing the offering would free up approximately 18% of our support team’s time and redirect nearly $1.2 million annually in operational costs toward innovation in our core platform. These savings weren’t just financial—they represented capacity. With fewer distractions, our teams could move faster, iterate more efficiently, and deliver higher-quality updates across our primary products.

Communication was critical. We notified affected customers six months in advance, provided migration paths to alternative solutions, and offered extended support during the transition. While some expressed disappointment, the majority understood the rationale, particularly when we demonstrated how the changes would lead to better overall service. Internally, the shift strengthened our alignment around strategic priorities. Departments from sales to engineering began speaking the same language—focused on scalability, efficiency, and long-term value creation. When we presented this streamlined structure to underwriters, their feedback was overwhelmingly positive. They saw a company willing to make tough choices, not just to clean up the portfolio, but to build a more coherent and investable business.

Building a Story Investors Can Believe In

An IPO is as much a marketing event as it is a financial one. Public markets reward companies that can articulate a clear, compelling narrative about their purpose, differentiation, and growth potential. Our product selection process became central to that story. Instead of presenting a broad array of offerings, we crafted a focused message: we solve one critical problem exceptionally well, and we’re expanding our impact through continuous innovation in that domain. This clarity resonated with investors who were comparing us to dozens of other pre-IPO companies vying for attention.

We worked closely with our marketing and investor relations teams to align product messaging with market trends and competitive positioning. For example, we emphasized how our flagship product addressed rising demand for automation in mid-sized businesses—a trend supported by third-party industry reports. We highlighted customer success stories, showing measurable improvements in efficiency and cost savings. These narratives weren’t fabricated; they were drawn directly from real-world usage, but we learned to frame them in ways that underscored scalability and defensibility.

Our S-1 filing and roadshow presentations reflected this disciplined approach. Rather than listing every product we’d ever built, we spotlighted three core offerings that represented over 85% of revenue and demonstrated clear growth trajectories. Each was tied to a specific market need, supported by data on adoption rates and customer satisfaction. This storytelling strategy did more than attract interest—it built credibility. Analysts noted our “unusual level of focus” and “clear line of sight to profitability,” comments that later appeared in research reports and influenced pricing during the offering. The lesson was clear: product selection isn’t just an operational task; it’s a foundational element of investor perception.

Balancing Innovation and Stability

Investors want evidence of innovation, but they also demand predictability. A company that appears too experimental risks being seen as unfocused or undisciplined, while one that shows no innovation may be perceived as stagnant. Striking the right balance was one of our biggest challenges during the IPO preparation phase. We had several early-stage projects in development—some promising, others speculative. While we wanted to show momentum, we also needed to avoid giving the impression that we were chasing every new trend.

To manage this tension, we adopted a tiered product framework: core, growth, and exploratory. Core products were our revenue engines—mature, stable, and highly profitable. Growth products were newer but already showing strong traction and clear paths to scale. Exploratory initiatives were R&D projects with high uncertainty but potential for future impact. Only the core and growth categories were highlighted in investor communications. The exploratory work continued, but it was framed as low-risk experimentation funded by profits from the main business.

This structure allowed us to demonstrate innovation without compromising credibility. We could point to tangible enhancements in our core platform—new features, expanded integrations, improved performance—while also showcasing upcoming releases in the growth category. At the same time, we avoided overpromising on unproven concepts. The tiered model also improved internal decision-making. It gave our product teams clear guidelines for prioritization and helped finance forecast more accurately. Ultimately, this balance reassured investors that we were both forward-thinking and grounded in operational reality—a combination that proved essential during the volatile weeks surrounding our public debut.

The Operational Ripple Effects of Product Decisions

Changing the product mix has consequences that extend far beyond the balance sheet. When we exited certain lines, we had to recalibrate nearly every function across the organization. Manufacturing schedules were adjusted to eliminate low-volume runs. Supply chain contracts were renegotiated to reflect new demand patterns. Customer service teams were retrained to focus on the remaining portfolio, and partner agreements were updated to align with our refined strategy. What began as a strategic product decision quickly became a company-wide transformation.

One of the most significant challenges was managing internal change. Some employees had deep emotional ties to discontinued products, especially those who had worked on them for years. Others worried about job security or shifts in responsibility. To address these concerns, we launched a cross-functional change management initiative. We held town halls, created internal FAQs, and appointed change champions in each department to facilitate communication. Transparency was key—we shared the financial rationale, long-term vision, and expected benefits openly and consistently.

The operational benefits became evident within months. With fewer SKUs to manage, inventory turnover improved by 23%, warehousing costs decreased, and order fulfillment accuracy increased. Our engineering team reported higher morale, as they could focus on meaningful improvements rather than maintaining legacy code. Sales cycles shortened because representatives spent less time explaining complex product variations and more time addressing customer needs. These efficiency gains weren’t just cost savings—they enhanced our ability to scale. When investors reviewed our operations during due diligence, they noted the lean, agile structure as a competitive advantage. The lesson was clear: strategic product decisions don’t exist in a vacuum. They reshape the entire organization, and when managed well, they create momentum that extends far beyond the IPO itself.

Lessons That Last Beyond the IPO

The IPO was a milestone, not an endpoint. The discipline we developed in product selection continued to deliver value long after the stock began trading. Our gross margins improved by 14 percentage points over the next two years, driven by operational efficiencies and higher-value offerings. Decision-making accelerated because we had fewer competing priorities. Brand identity strengthened as customers came to associate us with excellence in a specific domain rather than a broad, generic solution set.

Perhaps most importantly, we built a framework that others can adapt—even if they never plan to go public. The principles of focus, scalability, and strategic coherence apply to any business seeking sustainable growth. Whether you’re a founder refining your lineup, a product manager evaluating roadmaps, or a leader preparing for a major transition, the same questions remain relevant: Does this product align with our core mission? Can it scale efficiently? Does it contribute to a compelling long-term story? Answering these honestly—even when it means letting go—builds resilience.

Looking back, I realize that product selection wasn’t just a step in the IPO process. It was a test of leadership, clarity, and courage. It forced us to confront uncomfortable truths, make difficult trade-offs, and ultimately define what kind of company we wanted to become. The market rewards authenticity and focus. If you’re building something meant to last, start by asking not just what sells—but what matters.