How I Built My Emergency Fund Without Losing Sleep Over Risk

We’ve all been there—unexpected car repairs, sudden medical bills, or a job loss that throws everything off track. I learned the hard way that not having a financial cushion turns small crises into full-blown disasters. After one too many panic-filled nights, I committed to building an emergency fund the practical way: no wild risks, no get-rich-quick schemes. Just smart, steady moves that actually work. Here’s how I did it—and how you can too, without the stress. This isn’t about becoming rich overnight. It’s about creating stability, reducing anxiety, and making sure that when life throws something unexpected your finances don’t spiral out of control. The foundation of lasting financial peace isn’t found in high-risk investments or market timing—it’s in preparation, discipline, and knowing you’re protected.

The Wake-Up Call: Why Risk Avoidance Starts with Preparation

Life doesn’t wait for perfect conditions. For years, I believed I was managing my money well—paying bills on time, avoiding credit card debt, and even putting a little aside each month. But everything changed when my car broke down just weeks after an unexpected dental procedure wiped out my small savings. Faced with a $1,200 repair bill and no emergency fund, I had no choice but to use a credit card with a high interest rate. What should have been a manageable setback turned into a two-year debt cycle that drained both my finances and my confidence. That experience was my wake-up call: financial risk isn’t just about market crashes or bad investments—it’s about being unprepared for the ordinary unpredictability of life.

An emergency fund is not a luxury or a side goal. It is a fundamental risk management tool, as essential as car insurance or a smoke detector. Without it, even minor disruptions can force you into high-cost borrowing, late fees, or selling assets at inopportune times. The real danger of living without a safety net is that it forces reactive decision-making—choices made under pressure, often with long-term consequences. When you’re scrambling to cover an expense, you’re more likely to accept unfavorable loan terms, skip necessary medical care, or make emotionally driven financial moves that compromise your future stability. Preparation, on the other hand, shifts you from a reactive to a proactive stance. It allows you to face challenges with clarity rather than panic.

Many people confuse emergency savings with general savings or investment goals. But they serve very different purposes. A vacation fund or down payment goal can be flexible in timing; an emergency fund must be immediately accessible. The key distinction is intent: this money exists solely to absorb shocks, not to grow. That’s why the mindset shift—from seeing savings as a passive leftover to treating it as an active defense—is so critical. Once I reframed my emergency fund as a financial immune system, I stopped viewing it as money I was “missing out” on spending or investing. Instead, I saw it as protection that allowed me to take thoughtful risks elsewhere, knowing I had a buffer in place.

Emergency Fund vs. Investment: Why Timing Changes Everything

One of the most common financial misconceptions is that all money should be working to grow. While investing is essential for long-term wealth building, it operates on a different timeline and risk profile than emergency savings. The core purpose of an investment is to generate returns over time, accepting short-term volatility for the potential of long-term gains. An emergency fund, however, exists not to grow but to preserve—its sole job is to be there when you need it, regardless of market conditions. Confusing these two goals can lead to costly mistakes, especially during downturns.

Imagine facing a sudden job loss during a market crash. If your emergency savings are tied up in stocks or cryptocurrency, you’re forced to sell at a loss to cover basic expenses. That turns a temporary financial setback into a permanent one. Locking in losses under pressure is one of the most avoidable yet common financial errors. The timing of when you need money matters more than its potential return. An investment that drops 20% in value may recover in five years—but if you need that money in six months to pay rent, recovery time is irrelevant. Liquidity and stability are non-negotiable for emergency funds, even if it means accepting lower returns.

Some argue that keeping emergency savings in a low-interest account amounts to “losing” money due to inflation. While it’s true that inflation erodes purchasing power over time, the risk of losing principal or access to funds in a crisis far outweighs the modest gains from higher-return, less stable options. The emergency fund is not meant to beat inflation—it’s meant to prevent financial disaster. Once your safety net is in place, you can confidently invest surplus funds for growth, knowing you won’t be forced to liquidate them prematurely. This separation of purposes—protection first, growth second—is what enables sustainable financial progress.

Moreover, mixing emergency savings with investments can create psychological traps. When you see your emergency fund fluctuating in value, it becomes harder to trust it as a reliable resource. Market downturns may make you hesitant to use the money you need, even in a true emergency, because you’re hoping for a rebound. That hesitation can lead to delayed repairs, skipped medical visits, or increased stress—all because the fund wasn’t designed for stability. A truly effective emergency fund removes decision fatigue in moments of crisis. You shouldn’t have to calculate portfolio performance when your child is sick or your car won’t start.

The Right Place for Your Safety Net: Liquidity Over Returns

Where you keep your emergency fund is just as important as how much you save. The ideal location balances three key factors: immediate access, zero volatility, and minimal fees. These criteria rule out most traditional investment vehicles, including mutual funds, stocks, and even some savings bonds that impose penalties for early withdrawal. The goal is not to maximize interest but to minimize risk and ensure availability. Even a slightly higher return isn’t worth the cost of delayed access or complexity.

High-yield savings accounts offered by reputable banks or credit unions are often the best choice for most people. These accounts typically offer interest rates significantly above traditional savings while maintaining full liquidity and FDIC or NCUA insurance up to legal limits. Because the funds are accessible via transfer, ATM, or debit card, they can be used quickly when needed. Unlike certificates of deposit (CDs), which lock up money for a set term, high-yield savings accounts allow you to withdraw funds without penalty, making them truly flexible. While the returns may not match stock market averages, they provide steady, predictable growth with no risk of loss.

Money market accounts are another viable option, especially for larger emergency funds. They often come with check-writing privileges or debit cards, making them convenient for larger expenses. However, it’s important to distinguish between bank-based money market accounts and money market mutual funds, which are investment products and not insured. The former are protected and stable; the latter are subject to market fluctuations and should not be used for emergency savings. Always verify the nature of the account and confirm insurance coverage before depositing funds.

Some people consider keeping emergency cash at home for immediate access. While this might seem practical, it introduces significant risks: theft, loss, or damage with no recourse. It also earns no interest and is vulnerable to inflation. A better approach is to keep the majority in a secure, insured account and maintain a small amount of physical cash for extreme scenarios like power outages or banking system disruptions. The key is balancing accessibility with safety. Your emergency fund should feel invisible in daily life—there when you need it, but not tempting you to spend it on non-essentials.

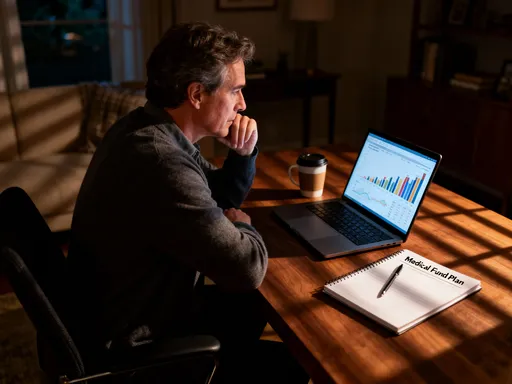

How Much Is Enough? Balancing Coverage and Overkill

There’s no one-size-fits-all answer to how large an emergency fund should be, but the most common guidance—three to six months of living expenses—is a useful starting point. The right amount depends on your personal risk profile, including job stability, income variability, household size, and access to other support systems. For someone with a steady government job and two incomes, three months of expenses might be sufficient. For a self-employed individual supporting a family with no backup income, six to twelve months may be more appropriate. The goal is not perfection but reasonable coverage tailored to your reality.

To calculate your needs, begin by tracking your essential monthly expenses: housing, utilities, groceries, transportation, insurance, and minimum debt payments. These are the costs you must cover to maintain basic stability. Multiply that total by the number of months you want to cover. If your essential expenses are $3,500 per month and you aim for six months, your target is $21,000. This figure may seem daunting, but it’s meant to provide peace of mind, not to be built overnight. The process should be gradual, consistent, and adaptable.

Under-saving is a clear risk—if your fund only covers one month, a single unexpected expense could still push you into debt. But over-saving can also be problematic. Tying up too much cash in a low-return account can delay other financial goals like homeownership, retirement savings, or education funding. Once your emergency fund reaches its target, redirect additional savings toward investments or debt reduction. The fund should be dynamic, adjusting as your life changes. A promotion, a new child, a career shift, or a move to a higher-cost area all warrant a reassessment of your emergency needs.

It’s also important to define what counts as an emergency. This fund is not for vacations, holiday shopping, or discretionary upgrades. It’s for true unforeseen events: job loss, medical emergencies, urgent home or car repairs, or essential family needs. Setting clear boundaries prevents erosion of the fund and maintains its integrity. Some people find it helpful to keep the emergency fund in a separate account with a different bank, reducing the temptation to dip into it for non-critical spending. The discipline of defining and respecting the fund’s purpose is as important as the amount saved.

Funding Without Sacrifice: Practical Strategies That Stick

Building an emergency fund doesn’t require drastic lifestyle changes or extreme frugality. The most effective strategies are those that become automatic and sustainable over time. The key is consistency, not size. Even small, regular contributions add up and create momentum. The goal is to treat your emergency fund like a non-negotiable bill—one that gets paid before discretionary spending. When you prioritize it as a fixed expense, you shift from saving what’s left to paying yourself first.

Automation is the most powerful tool for building savings without willpower. Set up a direct transfer from your checking account to your emergency savings account on the same day you get paid. Even $50 or $100 per paycheck can grow significantly over time. Because the transfer happens before you see the money, you’re less likely to spend it. Many banks allow you to schedule recurring transfers with just a few clicks, making the process effortless. Over 12 months, $100 per month becomes $1,200—enough to cover a major car repair or several months of groceries in a pinch.

Another effective method is the “double bill” strategy. Pretend your emergency fund has a monthly payment, just like your rent or car loan. Calculate what you can realistically afford—$75, $150, $200—and treat that amount as a mandatory transfer. When you pay this “bill” without fail, you build both savings and financial discipline. If you receive a bonus, tax refund, or cash gift, consider directing a portion—or all—of it to your fund. These windfalls can accelerate progress without affecting your regular budget. For example, a $2,000 tax refund added to monthly contributions can get you halfway to a $5,000 goal in a single year.

Micro-savings habits can also contribute meaningfully over time. Apps that round up purchases to the nearest dollar and deposit the difference into savings may not build wealth quickly, but they introduce the habit of saving without pain. More effective is the practice of saving small windfalls—like a $20 discount on a bill or the return of a deposit. Instead of spending it, transfer it directly to your emergency account. These amounts may seem trivial, but they reinforce the mindset that every dollar counts. The real power of these strategies lies not in the money saved, but in the behavior change they create.

The Trap of “Opportunity” — Why Risk Tempts When You’re Close

One of the most challenging moments in building an emergency fund is when you’re close to your goal—and then an “opportunity” arises. Maybe the stock market is booming, a friend is promoting a new investment, or there’s a limited-time sale on something you’ve wanted. The temptation to pause contributions or dip into the fund can feel justified: “I’ll just borrow from it and pay it back,” or “This could make me more money than I’m losing in interest.” But history shows that near-term gains often come at long-term cost.

Consider the story of a woman who paused her emergency savings to invest in a trending cryptocurrency. The price surged initially, and she felt smart—until the market corrected and she lost 40% of her investment. When her furnace failed months later, she had to use a credit card to cover the $1,800 repair. She ended up with both a depleted emergency buffer and high-interest debt. The short-term thrill of potential gain was erased by a single unexpected expense. This pattern repeats in countless forms: using emergency savings for a vacation, skipping contributions to afford a new gadget, or “borrowing” from the fund with the intention to repay—only to find the balance never recovers.

The psychological pull is strong because risk often masquerades as opportunity. But true financial security isn’t built on timing the market or chasing trends. It’s built on consistency, discipline, and the willingness to say no to short-term temptations. An emergency fund isn’t a barrier to opportunity—it’s what enables it. When you’re not living paycheck to paycheck or fearing the next crisis, you can make thoughtful decisions about career changes, education, or investments. You’re not forced to take high-risk bets out of desperation. The fund gives you the freedom to wait for the right opportunity, not grab the first one that appears.

Staying committed requires constant reinforcement of your “why.” Remind yourself of the peace of mind, the sleep you’ll get at night, the confidence you’ll feel when an unexpected bill arrives. Write down your goal and place it somewhere visible. Track your progress monthly. Celebrate milestones—not with spending, but with recognition of your growing control. The closer you get, the more critical it is to stay the course. Because the real reward isn’t the number in the account—it’s the transformation in how you experience money and life.

Living with Confidence: How a Fund Changes Your Financial Mindset

Once your emergency fund is fully funded and consistently maintained, something profound happens: your relationship with money shifts. Anxiety decreases. Decisions become clearer. You stop living in fear of the next unexpected expense. This isn’t just emotional relief—it’s practical empowerment. With a safety net in place, you can evaluate job offers based on fit rather than desperation, pursue further education without panic, or support a family member in need without jeopardizing your own stability. The fund becomes invisible in daily life but indispensable in moments of crisis.

Financial confidence doesn’t come from having the most money or the highest returns. It comes from knowing you’re prepared. That knowledge changes your risk tolerance in healthy ways. You can invest surplus funds with a long-term perspective because you’re not afraid of short-term downturns. You can negotiate better terms at work because you’re not terrified of losing income. You can say no to bad deals or high-pressure sales because you’re not scrambling to stretch every dollar. The emergency fund isn’t about avoiding risk altogether—it’s about choosing which risks are worth taking.

Over time, this mindset spreads to other areas of financial life. Budgeting becomes less restrictive and more intentional. Debt repayment accelerates because you’re not constantly borrowing to cover gaps. You begin to see money as a tool for stability and freedom, not just survival. The discipline of building and maintaining the fund strengthens your overall financial habits, making it easier to achieve other goals. It becomes the foundation upon which all other financial progress is built.

In the end, the emergency fund is not a financial chore or a sign of scarcity. It is an act of self-respect—an acknowledgment that you deserve protection and peace of mind. It reflects a belief in your own worth and a commitment to your future well-being. By building it wisely, without gambling on returns or sacrificing stability, you create more than savings. You create resilience. You create freedom. And you create a life where financial surprises don’t have to become financial disasters. That’s not just smart money management. That’s lasting financial peace.